6th Anniversary of Grenfell – 6th Tabling of a Consumer protection amendment for Buildings

16th June 2023 – The Earl of Lytton has tabled a new version of his consumer protection amendment for buildings in the House of Lords. It protects ALL homeowners from the costs of remediating historic Building Safety Defects (cladding and non cladding) as well as new defects discovered going forward.

This latest legal text clears up issues raised around judicial review risk and applies not just to England. Funding remediations is via an efficient out of court quasi judicial process or from a wide construction industry levy where a freeholder/developer can’t/won’t pay.

The amendment could be put to a vote in the upcoming Report stage of the Levelling Up and Regeneration Bill in the House of Lords September/November 2023.

Amendment text is at the following link: https://bills.parliament.uk/publications/52302/documents/3823

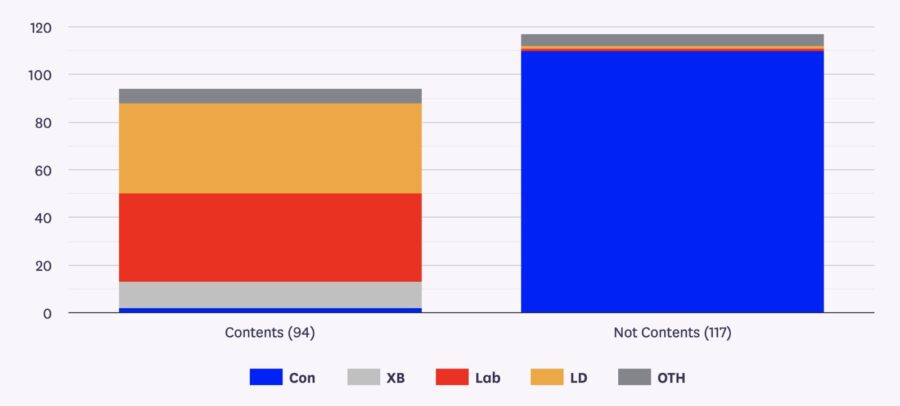

Previous House of Lords vote on earlier version of the amendment at Building Safety Bill Report stage:

It is hoped on the 6th Anniversary of the Grenfell tragedy that the government will implement this 6th tabling of this amendment, which protects all leaseholders from the costs of the #BuildingSafetyCrisis and also protects the future.

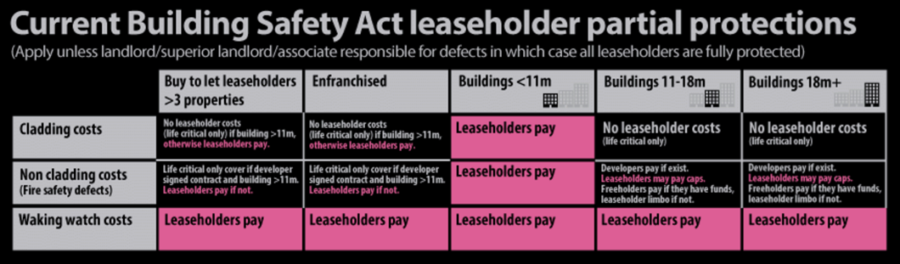

The problem (Building Safety Act, 2022 and Developer Remediation Contracts

The Grenfell fire in 2017 exposed a catastrophic failure in fire safety regulation that has left tens of thousands of people living in unsafe buildings. Leaseholders—through no fault of their own—were facing facing bills running into the tens, or even hundreds, of thousands of pounds for the remediation of fire safety defects. The Building Safety Act 2022 provides leaseholders with varying degrees of statutory protection from the costs of cladding and non-cladding remediation costs and interim safety measures (such as waking watches), with funding coming from the taxpayer (Building Safety Fund), developers (Building Safety Levy), and landlords. The UK’s largest developers are being pressed to agree to “voluntarily” fix “life-critical fire-safety defects” affecting buildings they were responsible for, on pain of having planning permission and building control sign-off revoked.

However, significant numbers of leaseholders receive little or no protection from non-cladding remediation costs—buy-to-let (BtL) owners with more than three properties, enfranchised leaseholders and those living in blocks below 11m. Statutory liability for remediation is placed on landlords whose financial interest in a building is generally relatively low, rather than developers. The significant number of unprotected leaseholders and a reliance on, in some cases, thinly capitalised or significantly indebted landlord groups creates a range of new credit risks for ground rent investors (often pension funds) and lenders.

Banks and building societies face increased credit risks, particularly in relation to their BtL portfolios. The threat of lease forfeiture, which has historically been a very rare event, could become a far more common outcome for many BtL and enfranchised owners, wiping out an entire lenders security unless further capital is provided. Pension funds that invested in ground rent funds face significant unanticipated costs. In the worst case a thinly capitalised or significantly indebted landlord group could fail with unknown consequences and costs for hundreds of thousands of people if unsalable freeholds escheat to the Crown.

Also for ‘protected leaseholders’ landlords that do not meet the contribution condition (net wealth below a set threshold) may charge leaseholders up to the £10,000/£15,000 caps before they need to contribute to remediation costs. However, to benefit from this exemption, they need to provide a landlord certificate to leaseholders setting out their net wealth calculation and supporting documents within tight timescales. There is considerable anecdotal evidence that landlords are failing to meet these deadlines or are basing their net worth on a group structure defined on an accounting basis rather than the definition set out in the BSA and secondary legislation. Any error in a landlord certificate means that landlords automatically become liable for remediation costs irrespective of their net wealth, increasing the likelihood of insolvency.

Unless all leaseholders are protected and the correct industry is made to pay for breaking building law, the rotten culture in the construction industry will continue. Full liability is the only way to ensure buildings of all heights are built to the required standards and future Grenfell’s are prevented.

Building a better future (Building Safety Remediation Scheme)

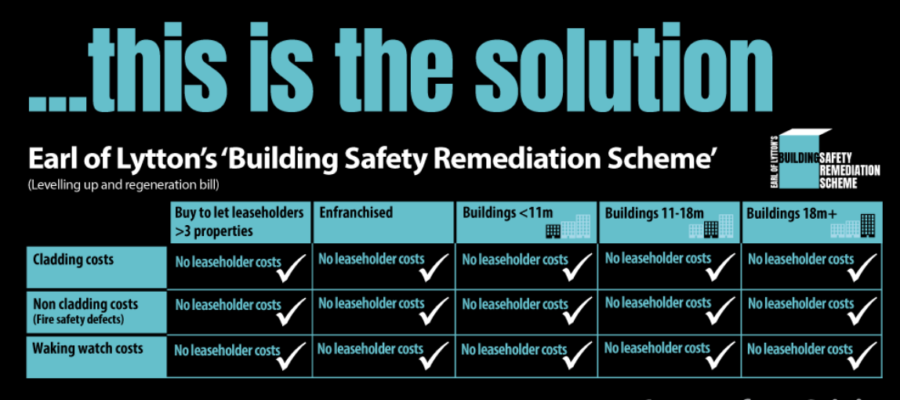

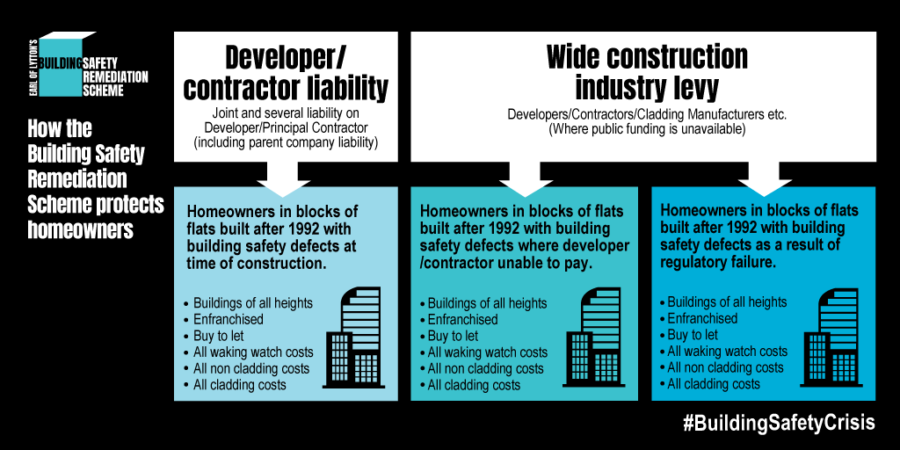

There is an alternative proposal that would substantially reduce the financial stability and public finance risks. An amendment, based on drafting by Daniel Greenberg (former parliamentary counsel and currently Parliamentary Commissioner for Standards) provides for an alternative comprehensive solution to the building safety crisis has already been tabled by the Earl of Lytton for discussion in the House of Lords. The proposed Building Safety Remediation Scheme (BSRS) envisaged under the amendment establishes a statutory scheme that covers all leaseholders. If a building did not comply with regulations in force at the time of construction, joint and several liability for remediation of all material building safety defects is placed on the developer and principal contactor. If neither are able to pay (or the building met the relevant regulations in force at the time of construction but is now, with later information, seen as unsafe), remediation funding would come from a levy on the construction industry rather than just developers as is currently proposed.

The BSRS provides leaseholders and their lenders with certainty that their homes will be fully remediated. But it does not just deal with the present crisis as it enshrines in law a low-cost mechanism to deal with similar situations in the future. With the Government, rightly, encouraging leaseholders to take greater control over the management of their buildings and seeking to reinvigorate commonhold, the BSRS provides a necessary layer of protection as the BSA specifically excludes enfranchised leaseholders and commonhold unit owners from all its protections.

How the BSRS Protects Homeowners

How the BSRS is Funded

Practical operation of the Building Safety Remediation Scheme

1. Block(s) of flats built after 1992, or where building work has occurred after 1992, requires remediation (cladding or non-cladding defects)

2. Freeholder/Building Owner applies to the Building Safety Remediation Scheme for a determination on (a) work required to remediate the building; and (b) whether the building was built to regulations in force at time of construction c) for a grant to remediate the defects identified and pay for waking watch.

3. Building Safety Remediation Scheme determines if the identified defects contravened the stated route to compliance at building control approval (ie BBA Certificates/Approved Document B/Bespoke routes to compliance) looking at basic installation defects such as missing cavity barriers, missing fire breaks, installation defects and internal fire stopping breaches.

4. If building regulation breaches at the time of construction are established then the Building Safety Remediation Scheme makes the developer/principal contractor joint and severally liable (or their parent companies) and the defects are published on a government public register of determinations website.

5. There is an appeals route via the FTT for building regulation breach and funding amount decisions, however as these are egregious cases, appeal risk will be low after a few initial test cases. No builder is going to be able to argue that missing firebreaks met regulations.

6. If building regulation breaches are difficult to prove or the developer/lead contractor group doesn’t exist or the defects are a result of regulatory failure then a wide construction industry levy including the cladding manufacturers funds the remediation and waking watch costs.

7. The Freeholder/Building Owner receives the funding to start the remediation without lengthy court proceedings.

Details

For further information on the Building Safety Remediation Scheme, the Earl of Lytton can be contacted at: [email protected]

Call to Action

If you are caught up in the Building Safety Crisis or want to help build political support for the cause please write to your MP and members of the House of Lords to ensure this once in a generation legislation makes it onto the statute book.